SageLend: Digital Loan Management Simplified

Empowering Dealers and Financial Institutions

SageLend by InnoSageTech is a comprehensive Digital Loan Management solution, tailored to streamline the entire loan processing lifecycle for various loan types, including vehicle loans, personal loans, and more. Our platform integrates seamlessly with BusinessNext and Salesforce CRM, enabling efficient and automated loan processing from partner registration to final disbursement.

End-to-End Digital Loan Management

Seamless Onboarding and Partner Portal Access

Partner Registration & Onboarding:

- Efficiently onboard dealers and partners with a streamlined registration process. Approved partners gain access to a powerful partner portal.

- Unified CRM Integration: The portal seamlessly integrates with BusinessNext and Salesforce CRM, ensuring synchronized and efficient management of all partner activities and loan applications.

Real-Time Monitoring and Notifications

Comprehensive Dealer Dashboard

Dealer Dashboard:

- A centralized platform for dealers to manage multiple loan applications, monitor statuses, and address rework requests.

- Custom Filters and Search: Dealers can filter and search applications based on status, customer name, or application ID, ensuring efficient management.

Customer Notifications:

- Keep customers informed with real-time updates on their loan application status, ensuring transparency and customer satisfaction.

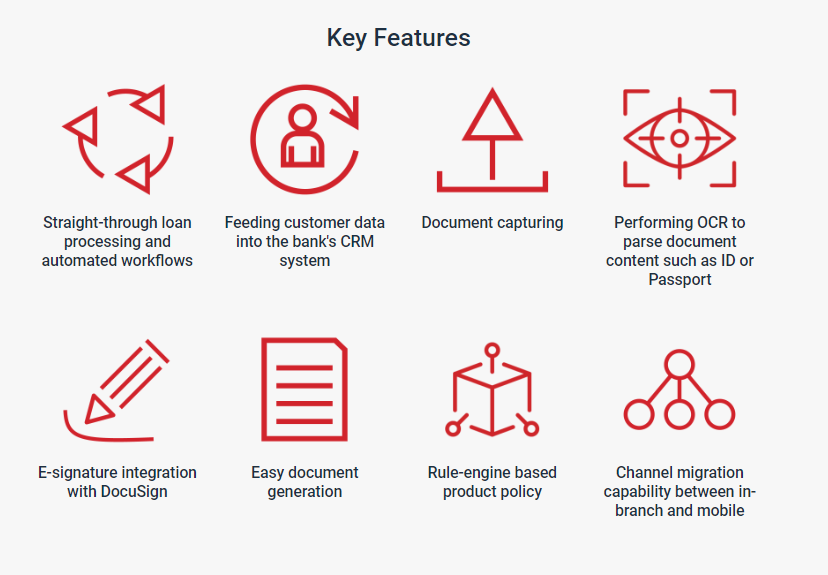

Key Features of SageLend Digital Loan Management

- End-to-End Loan Lifecycle Management: From customer onboarding to loan disbursement and servicing, manage the entire loan lifecycle seamlessly.

- Integrated eKYC and Credit Checks: Automate identity verification and credit evaluations with integrated APIs, reducing time and errors.

- CRM Integration: Seamless integration with BusinessNext and Salesforce CRM ensures that all data is managed efficiently and securely.

- Secure Document Handling: Upload, store, and manage documents with advanced security measures, ensuring compliance with regulatory standards.

- Real-Time Analytics and Reporting: Gain insights into loan performance and customer behavior with real-time analytics, helping you make informed decisions.

- Scalable and Compliant: Built for scalability and compliance, SageLend supports growing customer bases while adhering to global and local financial regulations.

Automated and Accurate Loan Processing

Efficient Data Management with eKYC Integration

Automated Data Pre-Filling:

- Utilize eKYC APIs to automatically pre-fill customer details, minimizing manual data entry and reducing errors.

- Credit Check Integration: Real-time credit scoring APIs provide immediate eligibility assessments, ensuring quick and accurate loan processing.

Streamlined Loan Application Workflow

Comprehensive Application Management:

- Manage the entire loan application process from submission to approval within the SageLend platform.

- Document Management: Securely upload, store, and verify necessary documents while ensuring regulatory compliance.

6 Steps to a Seamless Digital Loan Process

Step 1:

Loan Origination

• Using Loan Calculator to select the amount and duration of the loan to instantly find out the monthly installment amount

• Pre-approved offers for simple, hassle-free and fast loan applications

• Ensuring a personalized customer journey with Next Best Offer

Step 2:

Application and Data Capturing

• Online application: offering a fully-digital, customer-driven lending experience

• Customer identification: complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations

• Document checklist: handling large volumes of loan documents swiftly and accurately with Optical Character Recognition (OCR) technology

• Digital verification for proof of customer (income and repayment capability)

Step 3:

Loan Processing

• Using BusinessNext CRM capabilities to define a list of pre-approved automated loan checks

• Swift decision-making processes to facilitate pre-approved offers and instant loan approvals

• Connecting to multiple credit checking organizations

Step 4:

Underwriting

• Integrating eligibility calculator to reduce acquisition costs

• Approval in principle for customers with limited data

Step 5:

Loan Approval

• Digitizing confirmation process to onboard the new customer

• Robust decisioning engine for fast decisions and instant disbursement

Step 6:

Disbursement

• Simplifying loan applications with digital signature workflow

• Handling documents digitally from template automation to printing, document scanning to archiving